Easypaisa users can apply for an EasyCash loan through the app or via USSD. The loan can be repaid within 60 days for app users and 30 days for USSD users.

Digital banking apps make it easy to manage your finances without having to go to a bank. I’m a big fan of these apps, and my favorite is Easypaisa.

I use Easypaisa for all sorts of things, like paying bills, transferring money, and even playing the one-rupee game (I’ve never won, though).

Recently, I tried out the EasyCash feature, which lets you borrow money from the app and use it for your transactions.

In this article, I’ll walk you through how to get a loan using Easypaisa and what you’ll need to do before applying.

also Read: 6 Best Instant Loan Apps in Pakistan 2023 with Low Interest Rates

What Is Easypaisa Digital Loan?

Easypaisa EasyCash is an online credit facility that allows Easypaisa users to borrow money up to PKR 10,000. However, only users with the highest credit scores are eligible for the highest loan amounts.

Easypaisa is a popular digital banking app in Pakistan that offers a variety of services, including money transfers, bill payments, and now, loans. EasyCash is a short-term loan that can be used for a variety of purposes, and it’s available to users with good credit scores.

EasyCash loans are short-term loans that must be repaid within 60 days for app users and 30 days for USSD users (only Telenor users). The money is transferred to your account quickly, so you can use it right away. There’s no need to worry about paperwork or long processes.

Who Is Eligible for an Easypaisa Loan?

To be eligible for an EasyCash loan, you need to have a good credit score and a Telenor number. If you don’t have a Telenor number, you can apply for the loan through the Easypaisa app.

Easypaisa won’t give a loan to accounts that have been inactive for more than 90 days. You also need to be an active user and have a decent amount of money in your account at some point.

Applying for an Easypaisa Loan via the App

You can apply for an Easypaisa loan through the EasyCash feature in the app. The amount of the loan you’re eligible for depends on your credit score, but it can be up to PKR 10,000.

Here’s how to apply for an Easypaisa digital loan:

- Open your Easypaisa app and log in.

- Tap on the EasyCash option on the main page or search for it in the search bar.

- Select your marital status and occupation, and enter your father’s or husband’s name. Then, tap on “Apply for EasyCash”.

- You can see your credit rating on the next page. Tap on the rating to view your exact credit score.

- The maximum loan amount you can apply for will depend on your credit score. In my case, I can apply for a maximum loan amount of PKR 1,000 because my credit score is 506.

- Go back to the previous screen and enter the desired loan amount from the given range. Then, tap on “Next”.

- Review the loan details and weekly fee, and tap on “Get EasyCash” when you’re satisfied.

- You will be charged 5% weekly interest on the loan amount, which equates to roughly 20% per month.

- Your loan amount will be deposited in your account, and a message will be sent to your registered number for confirmation.

Interest Rate

Before applying for an Easypaisa loan, it’s important to understand the interest rates and payment dates so you can avoid additional fees and have a clear plan for repayment.

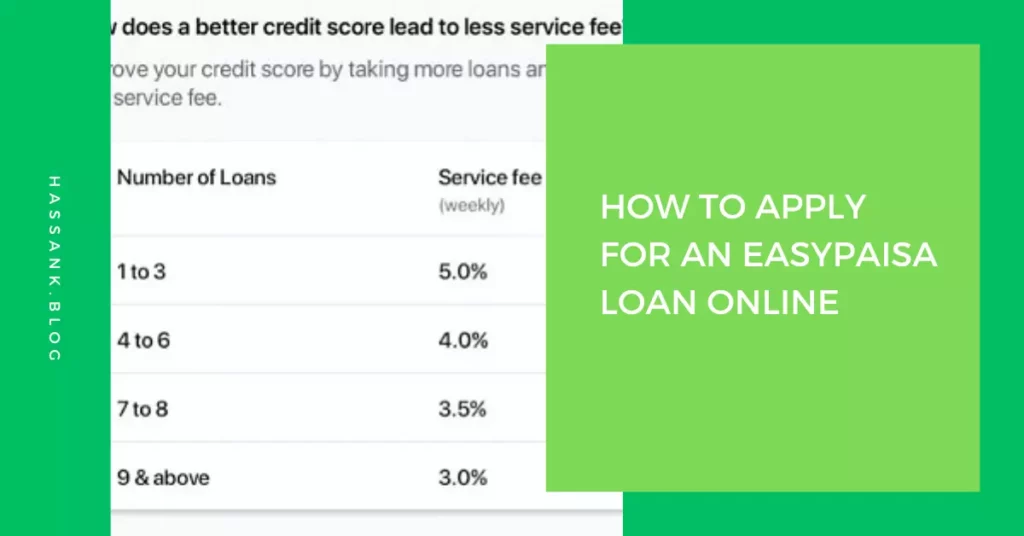

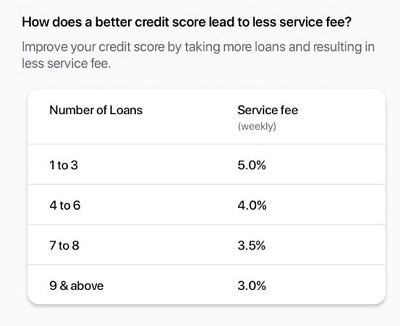

Easypaisa charges interest rates between 3% and 5% for users with good credit scores. The interest rate you’re offered will also depend on other factors, such as:

- Your Easypaisa account usage

- How often do you make payments?

- How many loans you’ve taken out

It’s important to read the terms and conditions carefully before applying for a loan so you know exactly what you’re getting into.

The interest rate I am getting on my Easypaisa loans is screenshotted below.

How to Repay the Loan

Easypaisa will automatically deduct the loan amount from your Easypaisa account on the due date. However, you can also choose to repay the amount at any time before the due date by going to the loan menu and selecting the “Repay” option.

If you don’t repay the loan in full by the due date, your Easypaisa account transactions will be halted until you make the full payment.

What Happens in the Case of Non-Payment of the Loan?

If you fail to repay an Easypaisa loan, your Easypaisa account will be blacklisted and you will be reported to the Credit Bureau of Pakistan (CBP). This will make it difficult for you to get a loan from any other lender in the future. You may also be taken to court and forced to pay back the loan, plus interest and legal fees.

Conclusion

Easypaisa offers simple and small digital loans to its users. To be eligible, you must have an active Easypaisa account and account history.

Keep in mind the interest rate and service charges that Easypaisa charges on its loans. To minimize the extra payments in interest, try to avoid delaying the payment and pay off the loan as quickly as possible.